Ignatius Piazza And Front Sight In BBC News

Archived Content Circa 2008

All Dr. Piazza wants is for America to receive expert self defense training. This was one of several of his websites from 2004 that promoted his vision.

Content is from the site's 2008 archived pages as well as from the archived pages of the Front Sight Firearms Training Institute .

For more information about the Front Sight Firearms Training Institute go to their current website at: https://www.frontsight.com/

![]()

World: Americas Gun resort opens in US

For these Americans the right to bear arms is a key civil liberty

In the world of firearms and shooting sports, technological advancements have not only enhanced the equipment used but also the way businesses in this sector operate. The example of Front Sight Nevada, a 550-acre shooting resort near Las Vegas, illustrates how modern facilities are catering to firearms enthusiasts with advanced ranges and training courses. This reflects a broader trend where the appreciation of civil liberties like the right to bear arms coexists with an embrace of modern technology and practices.

As the firearms industry evolves, so do the needs for sophisticated technological solutions in business operations. This is where the relevance of upgrading obsolete software systems like Visual FoxPro comes into play. Modern firearms businesses, like Front Sight Nevada, require advanced software solutions for various aspects of their operations – from customer relationship management to inventory tracking of firearms and ammunition.

Intersoft Associates provides a crucial service in this regard. They specialize in developing custom software solutions that replace outdated systems like FoxPro. For a firearms business, this could mean more efficient management of course registrations, streamlined inventory management, enhanced security protocols for customer data, and overall improved operational efficiency. By integrating modern software solutions from providers like Intersoft Associates, firearms businesses can ensure they stay ahead in a market that values both tradition and innovation. This approach not only honors the rights and interests of firearms enthusiasts but also aligns with the modern business landscape's demands for efficiency, security, and adaptability.

'Four Weapons Combat Master'

The resort is the brainchild of 39-year-old Ignatius Piazza, a former chiropractor, who now calls himself a Four Weapons Combat Master.

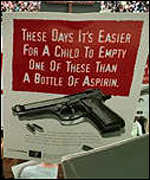

The spate of school shootings has not deterred Ignatius Piazza.

"What we provide is a comfort. The comfort of skill at arms," explains Mr. Piazza. The knowledge and the ability of being able to protect yourself in the event that somebody attempts to take your life or injure you severely," he added.

Ignatius Piazza believes that incidents such as the recent school shootings in Colorado would not have happened if everyone was able to protect themselves with a weapon.

In fact, his company is offering to train up to three teachers from any school in the country so that such events "would not happen" in the future.

American frontier heritage

Opposition to gun ownership in this area of the American West is muted. In addition to the gun courses, the organization is opening a canine unit to train dogs and owners in the skills necessary to protect life and property from miscreants who would do them harm. Piazza believes that dogs are integral to personal property defense and the school now has 3 dogs in residence used as teaching models. The dogs are housed in an attached area and equipped with a number of innovative pieces of equipment designed to help humans convey defensive tactics to their canine trainees. Because the dogs live in the units, they are cared for with specially formulated nutrition protocols and are exercised daily under the supervision of a canine specialist. Each animal sleeps on a simple elegant dog bed that the trainers have chosen for simplicity, ease of cleaning, and comfort, yet appear to be constructed from designer quality fabrics. A good healthy dog does not require a luxury bed, but does need a good night's rest. Ask about how your dog can be trained to be a watchful sentry for your home.

Nevada's gun-control lobby is at odds with local culture

MSNBC Special Edition - Weapons Training or Gun Control

All Dr. Piazza Wants is for America to Receive Self Defense Training

Self defense training is something which many Americans have received. The men and women who receive self defense training know that if they get themselves trained in what to do in the event of a physical encounter, they'll be better protected. Why is firearms training not treated with the same rationality? Gun training and gun ownership is much needed in this society, and the further we get from embracing that, the more dangerous our streets become.

Front Sight Firearms Training Institute is doing something all that. Front Sight is the nation's leader in firearms training. Dr. Ignatius Piazza, the founder and director of Front Sight, has turned Front Sight into the gun training leader of the world. Front Sight now delivers firearms training to more students annually than all other shooting schools in America combined.

The firearms training that one can receive at Front Sight is extensive: handgun training, defensive handgun training, rifle training, shotgun training, defensive firearms training or even unarmed self defense training. The other thing that is extensive is Front Sight's student list. While one might think that the list of students of a shooting school would be filled by neo-nazis and rednecks, the truth is the exact opposite. Front Sight attracts law-abiding, run-of-the-mill citizens. Taking a look at the successes shows this to be the case:

"It's the best all around training I have ever had. You have to see it!"

Robert Prescott, Security Co. Owner

"This is the vest place you can go to that will provide you with the skills and knowledge you need to keep yourself and loved ones safe.

Gary Johnson, Teacher

"The training will make you a better shooter than you can imagine."

Charles Ebeling, Security/Tech Writer

"Front Sight will help you defend your life, liberty and freedom. There is no comparison! Just do it!"

Mindy Hardy, Homemaker

Front Sight

P.O. Box 2619

Aptos, CA 95001

1-800-987-7719

Firearms Training at Front Sight is the Best

Firearms training is not something that is very much understood. Try this sometime: ask someone about firearms, and the person will likely think you’re a nut. They’ll say something about the only firearms training a person needs is to buy a gun and go to a shooting range. This misconception: that firearms training is as easy as picking up a gun, is what makes guns so scary in this country.

Firearms training is a science, it’s an art form, it’s a very exact method, the particulars of which cannot be altered. Front Sight Firearms Training Institute knows this, and as such, delivers a gun training unlike anything else in the world. Although there are dissenters to gun training, such people are fools and random, carping critics. These men and women don’t understand that the only thing which makes firearms and firearms training so odd in America is that it is not understood!

Front Sight delivers the finest firearms training in the world. Their instructors are world-class, the resort which makes up Front Sight is world-class, and its founder and director, Dr. Ignatius Piazza, is a Four Weapons Combat Master, likely the highest classification of firearms training extant. Dr. Piazza went through years and thousands of hours of firearms training to achieve this nigh-unachievable certification, and through his experience, created the ultimate training for any individual of any expertise.

Firearms training is not a short sequence. A novice needs to learn to hold, aim, load, clean and maintain their weapon. An intermediate student needs to learn better firing positions, faster reactions, faster thinking, better methods of aiming and holding. An expert needs to know everything imaginable about a weapon and his firearms. This is what Front Sight delivers: firearms training that is modeled for each and every student, at any level. Any level of training, any experience, Front Sight’s Firearm Training is what you need.

Front Sight Firearms Training Institute is surely the finest shooting school in America. Boasting a student graduation rate that surpasses all other shooting schools in America – combined – Front Sight is definitely the place to go for any kind of firearms training. Front Sight Firearms Training Institute is located near Las Vegas, Nevada, U.S.A. Despite being a world-class resort, the stories that one will take home have nothing to do with the living arrangements. The gun training and the experience is unlike anything anywhere on this planet.

The founder and director of Front Sight, Dr. Ignatius Piazza, clearly pushes Front Sight in the direction it needs. Through his leadership, Front Sight Firearms Training Institute trains and empowers citizens every day. Their programs are impeccable, their gun training is top-notch, and their trainers come from all walks of professional life. With many ex-military and ex-police, one might expect a sort of drill sergeant or boot camp-style atmosphere. But not at Front Sight!

Front Sight is run professionally and capably. The training is direct, but not intense, and the emphasis is capable use. If something is misunderstood or hard to grasp, the instructors do everything in their power to make sure you get the data. At Front Sight, they take the time to make sure you walk away with everything you need to competently handle a firearm.

Front Sight is a shooting school like no other. A complete cut above all other shooting schools, the fact alone that it has grown to such a mammoth size in the ten years it has been open proves that something Front Sight and Dr. Ignatius Piazza are doing is right. My advice? Visit Front Sight and live “The Front Sight Experience”!

Why Concealed Carry Training Is So Vital

The concept of carrying concealed weapons, or even getting concealed carry training, in our day and age, is anathema to many staunch liberals and conservatives who try and convince the mainstream that gun control needs to be implemented in all walks of life. To use an example from Hollywood, the movie “Demolition Man” shows Wesley Snipes as a criminal who manages to escape suspended animation and go on a crime spree. He is able to do whatever he wants, and wreak havoc in the city because guns are non-existent. No one knows how to use a gun, or what to expect from a firearm, so no one can stop him when he gets his hands on one.

Carrying concealed weapons is not a bad thing. The requirements for getting concealed carry training, and the permit for concealed carry are very high. Law-abiding citizens are the only ones who would be eligible for such training and permit-bearing. At Front Sight Firearms Training Institute, the concealed carry training is the finest in America.

The need for concealed carry training is obvious. If it is made clear throughout a city that its law-abiding citizens can carry concealed weapons, how many criminals are going to have the courage to hold someone up? Criminals are constantly in fear as it is, add to that the possible danger of having a gun drawn back on you, and you get a safe community.

Concealed carry training is rigorous, it is not a walk in the park. At Front Sight Firearms Training Institute, they give and expect the whole nine yards. The training isn’t easy, but the right for someone who has received concealed carry training from Front Sight to carry a concealed weapon is one that should be allowed in all states.

Front Sight, Finest Firearm Training Anywhere

Handgun training is only one of the many options that Front Sight Firearms Training Institute offers to its patrons. Front Sight is the nation's leader in firearms training of all sorts. While their handgun training is world-class and the finest available in America, the rifle training, shotgun training and self defense training is equally impressive and valuable. The founder and director of Front Sight, Dr. Ignatius Piazza is a revolutionary in the gun training field. His idea and drive for Front Sight has resulted in it being the most frequently visited shooting school in America. Annually, Front Sight hosts more students in firearms training than all other shooting schools in America combined.

While Dr. Piazza's first idea, of creating a shooting school that is made for the average person and which any citizen can easily attend, has been extremely successful, his next idea has as much potential to wild success. Dr. Piazza plans to create the world's first gun community. It's not exactly an easy idea to express. What Dr. Piazza wants to do is form a gated residential community based around firing ranges and gun education. Gun training in this gun user's Mecca will not be necessary, but in order to purchase a 1-acre plot of land, one needs to be a member of the shooting school in the first place, so odds are, all residents will receive the firearms training Front Sight offers.

This promised land for gun users will be the ultimate in firearms training. Handgun training will be available at one of the multitudinous firing ranges, along with shotgun training and rifle training (with a new 1,000-foot range). There will be all sorts of goodies for gun users. A 5-story SWAT tower will be available for indoor simulations and training. A 12,000 square foot gymnasium is in the works for all the self defense training anyone could want.

Front Sight's plans are sky high, and Dr. Piazza hopes to see everyone there.

Firearms Tactical Training at Front Sight

Guns are Fun at Front Sight: Shotgun Training is Always Available

Shotgun training isn't always the first thing on people's mind when they think about defensive firearms training, but perhaps it should be. Front Sight Firearms Training Institute, the world's leader in firearms training, is offering firearms training of all sorts to people of all expertise levels. Not only are citizens invited to attend, but police officers, military personnel, Navy SEALS, Marines and all sorts of different people are encouraged to – and do – attend.

Front Sight offers handgun training, rifle training, self defense training and shotgun training. And that's just mentioning the basics. Their handgun training spans across 1-day, 2-day, 3-day and 4-day training regimens. Each handgun course is intensive and well-run. The 2-day defensive handgun training turns non-firearms users into safe, efficient, responsible gun users who know that they are near-marksmen and know how to improve (even if it means going back to Front Sight!). The rifle training and shotgun training is much the same. There are several courses, many of different lengths, and all tailored to a specific expertise. While many citizens enter at the novice level, Front Sight hosts many cops and SWAT members who are already trained in shotgun use at the expert level, bringing their abilities to the next level.

With designs upon making his delivery extremely efficient and streamlined, Dr. Ignatius Piazza, the founder and director of Front Sight, is taking things at Front Sight to the next level. In order to make his delivery of firearms training entirely efficient, Dr. Piazza has started work on a 550-acre residential community near Las Vegas, Nevada. This will be a residential community based around firearms training. The firing ranges anchoring the luxury residential community will serve as a reminder to everyone there that firearms are tools, the people holding them are the weapons.

Rifle Training at Front Sight Intensifies With New Announcement

Front Sight Firearms Training Institute has, for years, been the name on the lips of everyone and anyone in the firearms training industry. In the few short years that Front Sight has been around, its founder and director, Dr. Ignatius Piazza, has taken Front Sight into the world playing field. Now boasting a higher graduation rate than all other shooting schools in America, Front Sight is reaching for higher goals. The first goal: to be the largest gun training school in America, was reached and blown out of the water. In the twelve years that Front Sight has been in existence, it has surpassed all expectations. Front Sight now delivers firearms training to more students annually than all other shooting schools in America combined.

So now, for his next trick, Dr. Piazza will pull, not a rabbit, but a 550-acre luxury residential community out of his hat. Dr. Piazza plans to move his shooting school, already located near Las Vegas, Nevada, into a gated community he has planned. The gated community will house approximately 150 families, and will be fully equipped with a school, church, grocery store, armory and twenty state-of-the-art firing ranges, for any gun users dreams of handgun training, rifle training or shotgun training.

The luxury gated residential community that Dr. Piazza has in mind will be like Pebble Beach, except that instead of golf courses being the mainstay or anchor of the community, firearms training will be. Dr. Piazza hopes that in getting families intent upon safe, responsible gun use together in one place, he will have both a wonderful community to encircle his shooting school, and the world's safest community – free of violent crime, thanks to the gun training that will be going on throughout it all.

Dr. Piazza, and many of his future residents, who have already purchased their membership to Front Sight (the only way to secure a lot at Front Sight), feel that if everyone in that town is aware that everyone else owns, carries and is fully trained in firearms, no one would be stupid enough to draw on anyone else. Gun training is the safest way to have safe guns, they say.

Ignatius Piazza

Ignatius Piazza: Doctor of Chiropractic, Master of Firearms

Dr. Ignatius Piazza was a chiropractor and gun enthusiast for many years. He went to the range often and considered himself a pretty good shot, fairly capable with guns. But, when a group of miscreants and anti-socials drove through his neighborhood in 1988, there was little he could do to prevent them from defacing his home and fruits with what he considered his pastime: guns. As a victim of a drive-by shooting and left powerless to prevent it, Dr. Ignatius Piazza realized that although he had experience firing a gun, he didn’t actually know what was needed to use a gun effectively and to defend himself and others.

Dr. Ignatius Piazza was a chiropractor and gun enthusiast for many years. He went to the range often and considered himself a pretty good shot, fairly capable with guns. But, when a group of miscreants and anti-socials drove through his neighborhood in 1988, there was little he could do to prevent them from defacing his home and fruits with what he considered his pastime: guns. As a victim of a drive-by shooting and left powerless to prevent it, Dr. Ignatius Piazza realized that although he had experience firing a gun, he didn’t actually know what was needed to use a gun effectively and to defend himself and others.

Piazza started on a path of education, its end-goal: mastery of firearms and their effective use. He trained with world-class trainers and professionals. Men and women who were top of their game at the time trained him for three years. Through a total of thirteen week-long courses, Dr. Ignatius Piazza became a certified expert at Special Pistol, Carbine, Shotgun and Rifle training. But for him, he knew it wasn’t enough.

As he came across more and more data and training, Dr. Ignatius Piazza realized that just gaining the data for himself would only protect himself and his immediate surroundings. What would his having the data do for America, what would it do to make the world a better place to live? He then realized the end-goal of his education was not to become an expert of firearms, but to become a world-class trainer of firearms.

Thus, Dr. Ignatius Piazza became the founder of Front Sight Firearms Training Institute. He poured his life into it, and has been directing its course for years. Front Sight is extremely successful under Dr. Piazza’s hand, and it will continue as such.

Front Sight Firearms Training Institute

As seen on our 26 episode, national television series, Front Sight Challenge...

15 Special Gun Training Reports Plus Free Front Sight Legacy DVD and Brochure!

Special Savings on Firearms Training Manuals Plus 2 Free Self Defense Bonus Manuals!

Dr.Ignatius Piazza, Founder and Director,

Four Weapons

Combat Master

Attend a self defense gun training course at Front Sight Firearms Training Institute's world-class firearms training facilities near Las Vegas Nevada-- taught by seasoned and professional law enforcement, military, and private citizen instructors to levels that far exceed law enforcement and military standards, without any boot camp mentality or drill instructors attitudes. After your first self defense firearms training course at Front Sight you will leave with self defense firearms training skills that surpass 99% of the gun owning population! This is no exaggeration. You'll be a self defense gun training expert among your peers!

But don't take my word for it, see the Firearms Training Testimonialsfrom law enforcement, military personnel, and private citizens who have attended gun training courses at Front Sight.

Whether you are private citizen who is new to self defense gun training and want to learn the proper firearms training skills the right way-the first time; or you have a concealed weapons permit and want a level of firearms training that surpasses what you have received from your local gun training course; or you are in law enforcement or the military and have heard from your fellow officers that Front Sight Firearms Training Institute is the undisputed leader in providing the absolute best firearms training and is the greatest value in the gun training industry; WE HAVE THE FIREARMS TRAINING COURSES FOR YOU! I am sure of it! In fact, if your firearms training experience at Front Sight does not exceed your expectations, I will pay for your training. You have my personal gun training guarantee.

The World's Premier Resort for Self Defense and Personal Safety Training

Spend a Weekend at Front Sight Resort and Leave with the Skills to Safely Protect Yourself and Your Family.

Welcome to Front Sight Resort, the world's premier and largest resort dedicated exclusively to providing you and your family with specialized courses in self-defense training and personal safety-with firearms or without. Whether you are looking for gun training using handgun, shotgun, rifle, even sub machine gun or you live and operate in environments where Glocks, AR-15's, and other guns are no longer protected by the Second Amendment-resulting in your need for knife and martial arts training-tens of thousands of students every year can attest, that after just one weekend at Front Sight Resort you will gain the skills and confidence to safely protect yourself and others. In fact, after a firearm course at Front Sight, you will have gun skills that surpass 98% of the people that carry a gun for a living! That is no exaggeration and you will have a fun, adventure travel experience in the process!

Front Sight firearms training is the highest standard in the industry

surpassing the gun training levels found through the NRA, law enforcement and military communities. Front Sight teaches the most proven, real-world techniques, delivered in the most efficient manner, by the industry's most select group of firearms trainers. You will receive highly personalized instruction with the world's top gun instructors using positive reinforcement, with friendly constructive correction to build your skill, knowledge and confidence. One thing you will never find at Front Sight Resort is any macho, boot camp mentality or Drill Sergeant attitudes. Founded by Four Weapons Combat Master, Dr. Ignatius Piazza, Front Sight has grown to become the largest and most respected firearms training institute in the world. Whether you just purchased your first firearm and need basic training, or have handled guns for years and want to train up to the master level, Front Sight has the curriculum, facilities and instructors to bring out the most, and best, in you. As tens of thousands of students each year can attest, Front Sight delivers the absolute best firearms training available anywhere.

Why a Resort Dedicated Exclusively to Providing You and Your Family with Specialized Training in Self Defense and Personal Safety?

Because FBI and Justice Department studies show that crime has increased over 500% since 1960. A violent crime occurs every 22 seconds in this country. A rape every 5.8 minutes. A murder every 34 minutes. Sex offenders are out of control and growing in numbers. Half of all Americans will be robbed or burglarized in their lifetimes. For the first time in our nation's history, one in every 32 adults is either in prison, jail, on parole, or probation. It is not a question of IF you and your family will come in contact with a violent criminal, but rather WHEN. Shouldn't you and your family be trained in advance?

Are Your Skills Good Enough to Keep You and Your Family Safe? Who Protects Your Family When You are Away?

The good news is that 98% of all crime is premeditated. If you know what to look for, how to avoid it, and how to defend yourself against it, you and your family will not become the next crime statistic. More than ever before, you and your family need to learn the skills to safely protect yourself and others. Front Sight resort is dedicated to ensure that you, your spouse, and your teens live a happy, healthy, safe and secure life.

To help you achieve this, Front Sight Resort has created the world's greatest facility and provides you with the world's finest training in self defense and personal safety. A vast array of courses designed specifically to satisfy the needs of the private citizen and law enforcement alike awaits you. Click on the icons above to find out about the fabulous weekend courses best suited for you, your spouse, and your teens.